Estate planning ensures your wishes are honored and protects your loved ones from legal and financial challenges after your passing. It is essential for preventing family disputes and ensuring smooth asset distribution.

1.1 Why Estate Planning is Critical Before Death

Estate planning is crucial to protect your loved ones from legal and financial challenges after your passing. Without proper documentation, heirs may face disputes, delays, and unnecessary costs. The 25 essential documents, including wills, POAs, and advance directives, ensure your wishes are respected and prevent potential conflicts. Planning ahead safeguards your legacy and provides peace of mind for your family.

1.2 The Consequences of Not Having Essential Documents

Without essential documents, your family may face prolonged legal battles, financial strain, and emotional distress. Assets can be mismanaged, and loved ones may be left without clear guidance, leading to potential conflicts and delays in settling your estate. Proper documentation ensures clarity and avoids costly challenges, safeguarding your family’s future and peace of mind.

The Last Will and Testament

A last will and testament is a legal document outlining how your assets will be distributed after your death. It ensures your wishes are carried out.

2.1 What is a Last Will and Testament?

A last will and testament is a legal document outlining how your assets, property, and possessions will be distributed after your death. It allows you to appoint an executor to manage your estate, name guardians for minor children, and specify final wishes. This document ensures your desires are honored and avoids disputes among heirs.

2.2 Key Components of a Will

A will typically includes the appointment of an executor to manage the estate, designation of beneficiaries for assets, and naming of guardians for minors. It may also outline funeral instructions and require signatures from the testator and witnesses to ensure validity. The will ensures that the testator’s wishes are legally enforceable and clearly communicated.

2.3 Why You Need a Will Before You Die

A will ensures your assets are distributed according to your wishes, prevents intestacy, and avoids costly legal battles. It appoints an executor to manage your estate and names guardians for minors. Without a will, state laws dictate asset distribution, potentially causing family disputes. A will streamlines probate, protects heirs, and guarantees your legacy is preserved as intended.

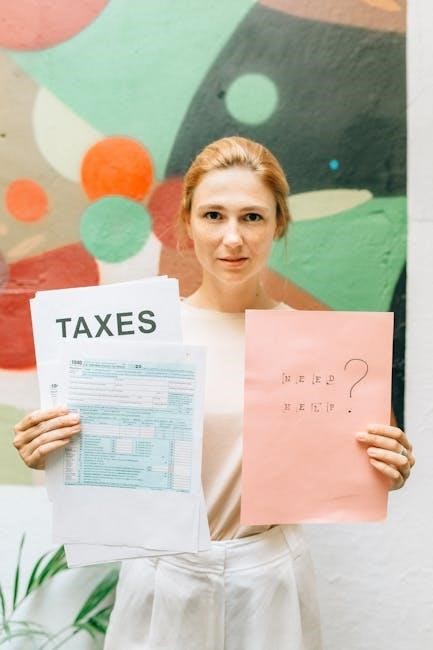

Financial Power of Attorney (POA)

A Financial Power of Attorney allows a trusted individual to manage your financial affairs, ensuring continuity in asset management, bill payments, and decision-making if you become incapacitated.

3.1 Understanding Financial Power of Attorney

A Financial Power of Attorney (POA) is a legal document granting a trusted individual authority to manage your financial affairs, including handling bank accounts, paying bills, and overseeing investments. It ensures continuity in financial decision-making if you become incapacitated, providing peace of mind and protecting your assets from potential misuse or neglect.

3.2 When and Why You Need a POA

A POA is crucial for ensuring your financial affairs are managed during incapacity, such as illness or injury. It allows a designated person to act on your behalf, preventing delays in decision-making and protecting your assets. Establishing a POA early ensures your wishes are followed and avoids legal complications for your family.

Advance Healthcare Directive

An Advance Healthcare Directive outlines your medical preferences and appoints a decision-maker if you become incapacitated. It ensures your wishes are respected and prevents family conflicts.

4.1 What is an Advance Healthcare Directive?

An Advance Healthcare Directive is a legal document that outlines your medical preferences and appoints a healthcare agent to make decisions on your behalf if you become incapacitated. It ensures your wishes regarding treatment are respected, preventing family conflicts and ensuring your autonomy in healthcare decisions. This document is crucial for maintaining control over your medical care when you cannot communicate your preferences yourself.

4.2 Importance of Having One in Place

An Advance Healthcare Directive is vital for ensuring your medical preferences are honored, preventing family disputes, and guiding healthcare providers in critical situations. It maintains your autonomy, even when you cannot communicate, and reduces legal challenges for loved ones. Having one in place provides clarity and peace of mind for both you and your family during difficult times.

Do Not Resuscitate Orders (DNR)

A DNR is a legal order instructing healthcare providers not to perform CPR if your heart stops or breathing ceases, allowing a natural death without intervention.

5.1 What DNR Orders Entail

DNR orders are legal documents specifying that no life-sustaining treatments, like CPR, should be administered if your heart stops. They allow natural death without medical intervention, ensuring your wishes are respected during a medical crisis.

5.2 When to Consider a DNR

A DNR is appropriate for individuals with terminal illnesses or severe health conditions where life-sustaining treatments would not improve their quality of life. It ensures medical staff respect your wishes to avoid extreme measures, aligning with your personal values and end-of-life preferences.

Personal and Family Information

Documenting personal details like full name, Social Security number, legal residence, and birth date ensures clarity for legal processes. Include spouse and children’s information for seamless estate execution.

Recording family history and emergency contacts provides heirs and executors with essential information for notifications and decision-making, ensuring everything aligns with your wishes.

6.1 Essential Personal Details to Document

Documenting essential personal details, such as full legal name, Social Security number, legal residence, and birth date, ensures clarity for legal processes. Include marriage licenses, divorce papers, and military records. Listing spouse and children’s names, addresses, and contact information is vital for notifications and estate execution. Organizing this information helps heirs and executors manage your estate efficiently and align with your wishes.

6.2 Importance of Family History and Contacts

Documenting family history and contacts ensures your loved ones are notified and involved in estate matters. Include names, addresses, and relationships of immediate family, heirs, and executors. Listing emergency contacts and medical history aids in healthcare decisions. Organizing this information prevents delays and ensures your wishes are carried out smoothly during estate settlement.

Letter of Instruction

A Letter of Instruction outlines personal wishes, funeral preferences, key contacts, and practical matters, simplifying estate settlement by providing clear guidance beyond your will for heirs.

7.1 What to Include in a Letter of Instruction

A Letter of Instruction should include personal wishes, funeral preferences, key contacts, disposition of the body, burial details, and obituary information. It also covers practical matters like passwords, safe combinations, and asset locations, ensuring your heirs understand your desires and can execute them without confusion or legal challenges.

7.2 How It Simplifies Estate Settlement

A Letter of Instruction streamlines estate settlement by providing clear, organized guidance. It eliminates guesswork, reduces conflicts, and ensures your wishes are carried out efficiently. This document helps heirs locate assets, access accounts, and manage logistics, minimizing delays and emotional strain during a difficult time.

Trust Documents

Trust documents allow you to control asset distribution, avoid probate, and provide tax benefits. They ensure your wishes are carried out, offering flexibility and protection for beneficiaries.

8.1 Types of Trusts and Their Purposes

Trust documents include Revocable Living Trusts, Irrevocable Trusts, Special Needs Trusts, and Charitable Trusts. Each serves specific purposes, such as avoiding probate, protecting assets, providing for beneficiaries with disabilities, or supporting charitable causes. They offer flexibility and control over asset distribution, ensuring your wishes are fulfilled while minimizing legal and financial complexities for your heirs.

8.2 Why Trusts Are Essential for Estate Planning

Trusts are vital as they bypass probate, ensuring privacy and faster asset distribution. They protect beneficiaries from creditors, manage inheritance for minors or those with special needs, and maintain control over asset use. Trusts also reduce estate taxes, offering a secure and efficient way to fulfill your legacy while safeguarding your family’s financial future effectively.

Estate Inventory and Asset Management

Creating a comprehensive list of assets ensures clarity and organization, reducing stress for heirs. Include properties, bank accounts, investments, and valuables to streamline estate distribution and management processes effectively.

9.1 Creating a Comprehensive List of Assets

A detailed inventory of all assets, including properties, bank accounts, investments, retirement funds, and personal valuables, ensures nothing is overlooked. Documenting each asset’s location, account numbers, and ownership details helps heirs avoid confusion and facilitates smooth estate distribution. This step is crucial for preventing oversights and ensuring all possessions are accounted for and properly managed.

9.2 How to Organize and Store Estate Documents

Store estate documents in a fireproof safe or safe deposit box, ensuring accessibility to trusted individuals. Maintain a list of document locations and provide copies to your attorney or executor. Digital backups, like encrypted cloud storage, add an extra layer of security. Organize documents logically, such as separating financial records from personal items, to streamline access and verification.

Beneficiary Designations

Beneficiary designations control how assets like life insurance and retirement accounts are distributed, bypassing probate. Regular updates ensure accuracy, especially after life changes like marriage or divorce.

10.1 Importance of Updating Beneficiary Information

Updating beneficiary information ensures assets are distributed according to current wishes, preventing disputes and financial hardships. Life events like marriage, divorce, or death necessitate regular reviews to maintain accuracy and alignment with estate goals.

10.2 How Beneficiary Designations Work

Beneficiary designations determine who receives assets like retirement accounts or life insurance upon death. These designations override will instructions, ensuring direct transfers without probate. Proper completion and updates are crucial to align with estate plans and avoid unintended outcomes for heirs.

Safe Storage and Access to Documents

Store estate documents securely, such as with an attorney, in a safe deposit box, or a fireproof safe. Ensure a trusted individual knows the location and access details.

11.1 Where to Store Your Estate Documents

Estate documents should be stored securely to protect them from loss or damage. Consider keeping them with a trusted attorney, in a fireproof safe at home, or a safe deposit box at a bank. Additionally, digital storage solutions with secure access can be used. Ensure that a trusted family member or executor knows the location and has access. This ensures your wishes are carried out without unnecessary delays.

11.2 Ensuring Loved Ones Can Access Them

Ensure your estate documents are accessible by sharing their location with trusted family members or executors. Provide clear instructions, such as combinations for safes or keys for safe deposit boxes. Consider creating a master list of document locations and storing it securely. This prevents delays and ensures your loved ones can act swiftly when needed.